Would you be surprised that Norway has already achieved over 80% pure electric vehicle sales and aims to end sales of internal combustion engine (ICE) passenger and light commercial vehicles by 2025?

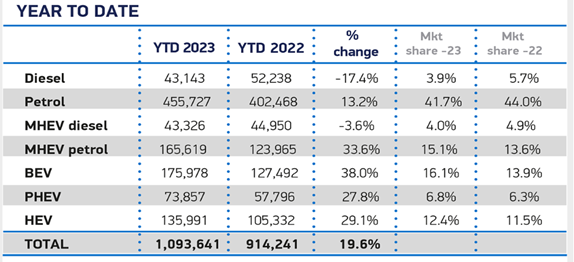

In the UK, currently, 2030 is the target. Currently, pure battery electric vehicle (BEV) sales make up 17% of the market, indicating the growing popularity of EVs as they become more mainstream on the roads.

In the UK, the used market for BEVs has faced significant limitations due to low sales of new cars in the previous 3-4 years.

There haven’t been enough cars to establish a thriving second-hand market. As a result, the prices for used electric vehicles (EVs) are relatively high, exceeding the typical depreciation rates for most cars. However, this trend may soon shift with the recent rapid increase in new EV sales.

It seems that there is a decent amount of 2 to 4-year-old vehicles coming available in the marketplace, and the number of used EVs on the market increased by 200% in May 2023 compared to the same time last year; inevitably, there has been a fall in the price of used EVs.

The decrease in residual values resulting from this trend is a positive development for the new EV market. This will likely encourage more people to adopt new electric vehicles, especially if the prices are comparable to the equivalent ICE.

Given that the UK has committed to banning the sale of new petrol and diesel cars in just seven years. Manufacturers will know that rising used EV availability will create a viable option for potential owners, especially for cars purchased on a Personal Contract Hire.

UK committed to banning the sale of new petrol and diesel cars.

In addition, in this 7-year this timeframe, we should also witness significant improvements in the electric-charging infrastructure.

It is worth noting that the decreasing prices of Battery Electric Vehicles have created an interesting correlation with the prices of ICE vehicles in the UK market, which have remained stable.

This has decreased the price difference between BEVs and ICE vehicles, which is a crucial factor for savvy buyers considering acquiring a vehicle.

Another reason for the price parity is that the EV industry has not been standing still, working to address the common objections of BEVs, improving output, and opening up weak supply chains, post the Covid era.

Falling Production cost

The good news overall is that the production cost of new EVs is rapidly decreasing and is projected to match that of conventional ICEVs by 2024. EVs could become less expensive to manufacture in the near future.

Electric vehicles typically rely on advanced battery technology, electric motors, sophisticated power electronics, and various electronic components, including Multilayer Ceramic Capacitors (MLCCs).

MLCCs are critical electronic components used in a wide range of devices, including EVs, smartphones, computers, and other electronic gadgets.

Supply Chain Improvements

In recent years, the global electronics industry has faced a shortage of MLCCs due to various factors, including increased demand, supply chain disruptions, and limited production capacities from manufacturers.

This shortage has resulted in increased prices for MLCCs and other electronic components, which can temporarily impact the production costs of electric vehicles.

They are still in high demand across various industries, including automotive, telecommunications, and consumer electronics. They have been in short supply with the European Motor Manufactures who were at the back of the queue due to their “Just in time” supply model.

However, the situation is dynamic, and the industry has been working to address these challenges by expanding production capacities and optimising supply chains.

Battery Costs

When it comes to battery technology, it’s a fact that improvements in battery chemistry and manufacturing methods have been steadily reducing the physical cost of battery packs for electric vehicles.

Lithium, the common ingredient in almost all electric-car batteries, has become so precious that it is often called white gold. But something surprising has happened recently: The metal’s price has fallen, helping to make electric vehicles more affordable.

The cost of lithium, an essential component in EV batteries, has dropped by nearly 20% since January, while the price of cobalt, also an important material for batteries, has fallen over 50%; the price of copper has dipped nearly 20% (April 23)

As more research and development is conducted, it’s anticipated that battery expenses will continue to decrease, ultimately making electric vehicles more accessible and economical.

The ICE ban effect.

Worldwide, there are impending bans on selling new petrol and diesel cars. In the UK, officially, the ICE ban comes into effect in 2030, a date that has already been brought forward to meet national climate goals.

As the new legislation draws near, manufacturers face increased pressure to make their electric vehicles more affordable for drivers. Otherwise, they could lose a significant portion of their market to second-hand sales of older EVs or ICEVs.

China’s Battery Dominance

Additionally, the most important components of European electric vehicles have yet to be produced in Europe. Chinese manufacturers have an advantage with a localised supply chain that will take time for Europe to match.

While gigafactories are under construction, European manufacturers are shipping battery packs worldwide, which can be costly, potentially dangerous, and slow.

Ultimately, cheaper electric vehicles will make the transition more affordable for drivers and businesses, encouraging European manufacturers to compete on price, as they already have with Tesla.

There is some concern, however, about this rush to great-value Chinese cars; at the recent EU meeting that increased the ban on new ICE vehicles to 2035, Italy’s Prime Minister Giorgia Meloni also vowed to forcefully oppose the planned car ban arguing” “they are deeply damaging to our manufacturing sector.”

Italy’s Transport Minister Mateo Salvini has argued that this ban on ICE cars will effectively hand the EU blocs car market to the biggest electric vehicle manufacturer, China, and cost hundreds of thousands of jobs.

Economies of Scale

As the production volume of EVs has increased, economies of scale have come into play. Larger production runs allow manufacturers to spread fixed costs (like research and development, tooling, and facilities) across more vehicles, which can lead to cost savings.

Investment in research and development in the EV sector has led to ongoing innovations in materials and manufacturing techniques,

Efficient, cost-effective battery recycling technologies that can help recover valuable materials from used batteries, reducing the need for raw materials and lowering production costs.

Infostructure Improvements

Based on recent trends, the notion that electric vehicles are significantly more expensive is no longer as accurate as it once was, despite what the media may lead us to believe.

Improving battery technology and addressing the issue of range anxiety, as seen in the upcoming VW iD2 release in 2025. This vehicle will have a range of 450km and cost less than 25,000 euros.

Finally, regarding the infostructure for charging mass EVs, this issue is not the case in Norway, which is on track to achieve its objectives by 2025, 5-10 years ahead of the UK and Europe.

To tackle the infrastructure issue, the EU has implemented a new law mandating the installation of fast-charging stations every 60 kilometres on highways by the end of 2025.

Ambitious Targets

According to the law, charging stations for electric vehicles must be interoperable, which means they should work with all types of electric vehicles, regardless of their manufacturer. This is an important issue addressed in the UK electric vehicle infrastructure strategy.

The EU has set a goal of having 1 million public charging points by 2025 and 3 million by 2030.

New EU regulations will mandate the installation of fast-charging stations along highways every 60 kilometres (about 37 miles) by the end of 2025. The stations must have a total output of 400 kW for cars and vans and 600 kW for heavy-duty vehicles.

The law also requires EV recharging stations must be placed every 60km in the core network and every 100km in the peripheral network.

They should have a total output of 600 kW and at least one charger with a minimum output of 150 kW. This network wil be completed by 2030.

The EU is potentially the world’s largest market for electric vehicles, and the new law is expected to help boost sales of EVs in the region.

The Way Forward

The World Economic Forum reports that the shift towards electric vehicles (EVs) is already underway, driven by growing environmental awareness, government policies, and monetary incentives.

Smart charging technology has been introduced to enhance the charging infrastructure and customer satisfaction.

Additionally, smart energy management systems help manage EV and stationary loads, minimising the risk of grid overload while promoting renewable energy sources.

Battery monitoring, analysis, and recycling help reduce the shortage of necessary battery minerals by increasing their lifespan and reusability.

It’s best to follow the money when it comes to finding the most advantageous deal for motorists. No matter how virtuous you are, for most of us, the deal counts.

Those considering the environment the top priority have been using EVs since the first Nissan Leaf rolled off the production line in 2010.

Eventually, the market will align and offer the total EV package range, info structure and the right price, which will attract more customers. This has been proven in Norway, where the government implemented tax incentives to encourage a transition to eco-friendly vehicles.

As a result, Norwegian motorists were pleased with the deal and its positive impact on the environment, prompting them to sign up.