PCP vs Leasing (PCH): The Definitive 2025 UK Guide

1. Introduction: The Two Biggest Finance Options

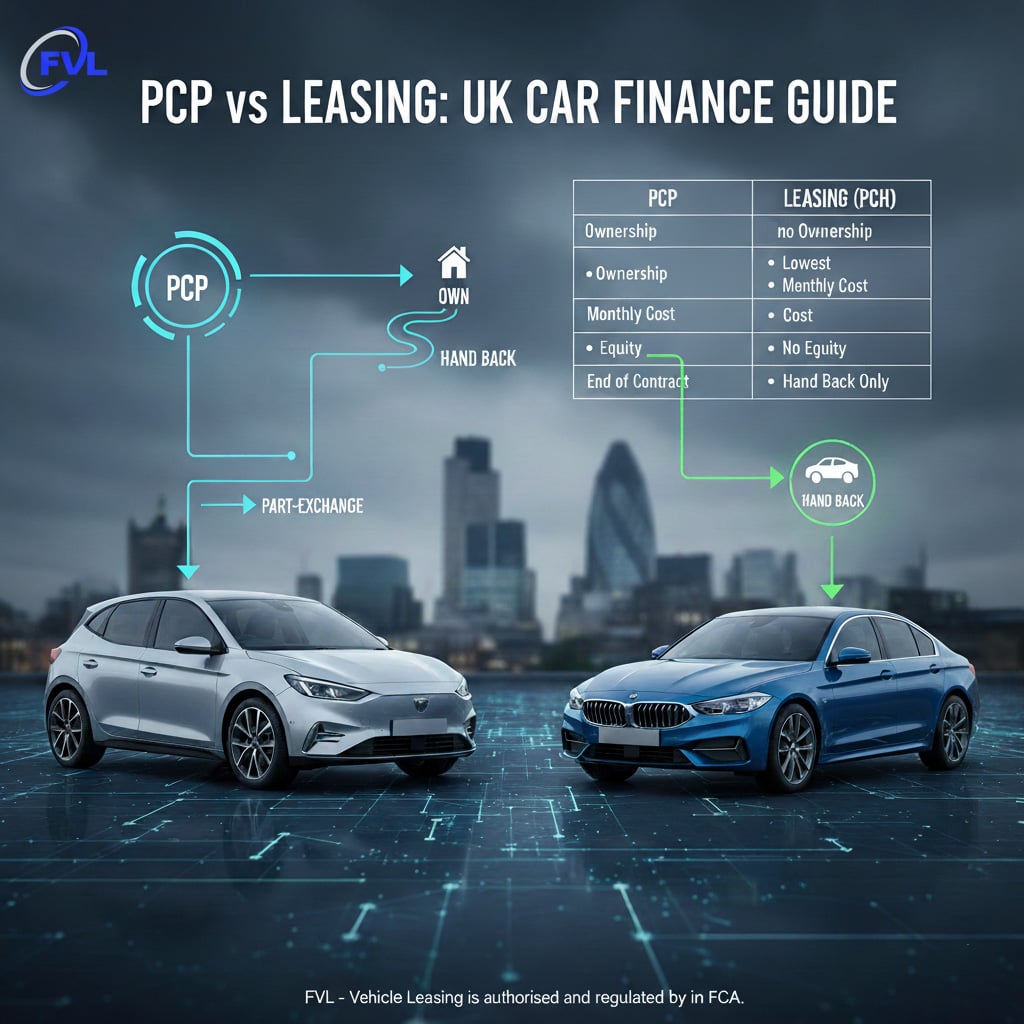

You've chosen your new car. Now comes the most important decision: how to pay for it. In the UK, it will almost certainly come down to two options: PCP (Personal Contract Purchase) and Leasing (Personal Contract Hire, or PCH).

They look similar—you pay an initial amount, make monthly payments, and drive a new car for 2-4 years. But crucially, they are built differently and are designed for two different types of drivers. One is a path to potential ownership; the other is the simplest, purest form of usership.

As a credit broker, this is the most common question we get. This definitive guide will cut through the jargon and give you an expert, side-by-side comparison to help you make the right financial decision. For an overview, read our guide to how car leasing works.

First Vehicle Leasing Ltd is authorised and regulated by the FCA (Ref. 670872) as a credit broker, not a lender.

2. Quick Comparison: PCP vs. Leasing (PCH)

Here is the "at-a-glance" summary. We will explore each of these points in detail below.

| Feature | PCP (Personal Contract Purchase) | Leasing (PCH - Personal Contract Hire) |

|---|---|---|

| End of Contract | 3 Options: Pay balloon to buy, part-exchange, or hand back. | 1 Option: Hand the car back. |

| Ownership | You do not own the car, but have the option to buy it at the end. | You will never own the car. It is a long-term rental. |

| Monthly Payments | Covers depreciation + interest on the total car value. Often slightly higher. | Covers depreciation only. Often the lowest possible monthly cost. |

| "Equity" | Possible. If the car is worth more than the GMFV, you have equity. | Not possible. You can't profit, but you also can't lose money. |

| Mileage | An agreed mileage sets the GMFV. Going over reduces equity or incurs a penalty if returned. | A hard contract limit. You pay a fixed penalty for every mile you go over. |

| Maintenance | Usually not included. You are responsible for all servicing. | Often available as a fixed-cost maintenance package. |

| Wear & Tear | Reduces your car's value, lowering your equity or part-exchange value. | Assessed at collection. You pay penalty charges for anything outside the BVRLA standard. |

3. Key Terms You Must Know (GMFV, Equity, etc.)

You cannot compare these products without knowing the language. This is what separates them.

- PCP (Personal Contract Purchase): A finance product where you pay off the car's depreciation with the option to buy it at the end by paying a large final sum.

- PCH (Personal Contract Hire / Leasing): A long-term rental. You are paying only for the car's depreciation. You have no option to buy.

- GMFV (Guaranteed Minimum Future Value): PCP ONLY. The finance company's guaranteed value for the car at the end of the contract. This is the "balloon payment."

- Balloon Payment: PCP ONLY. The large, final payment (the GMFV) you must pay to own the car.

- Equity: PCP ONLY. The positive difference between what your car is actually worth and its GMFV. (e.g., GMFV is £15,000, but the trade-in value is £17,000. You have £2,000 equity).

- Initial Rental / Deposit: The upfront payment you make. On PCH, it's a rental. On PCP, it's a deposit that reduces the loan amount.

4. What is PCP (Personal Contract Purchase)?

PCP is a finance agreement to buy a car, but the payments are structured to keep them low. You pay an initial deposit, then a series of monthly payments. Those payments are not paying off the full car; they are only paying off the depreciation (the difference between the starting price and the GMFV) plus interest on the total loan.

The magic of PCP is at the end. You have three options:

- PAY: You pay the final "balloon payment" (the GMFV) and keep the car. You are now the legal owner.

- PART-EXCHANGE: You trade the car in at a dealership. They value it, pay off the GMFV for you, and any "equity" left over is yours to use as a deposit on your next car. This is what most people do.

- RETURN: You hand the car back to the finance company, pay any mileage or damage penalties, and walk away. (This is exactly like PCH).

PCP is all about flexibility and the option to own. Read our full guide to PCP.

5. What is Leasing (Personal Contract Hire)?

Leasing (PCH) is a long-term rental. It is the simplest and purest way to drive a new car. You are paying for one thing: the use of the vehicle. You pay an initial rental, then a series of fixed monthly payments.

These monthly payments are often lower than PCP because you are only paying for the vehicle's depreciation. You are not building any equity, and you are not paying interest on a future purchase price. At the end, you have one option:

- RETURN: You hand the car back. The finance company inspects it for wear and tear and checks the mileage. You pay any penalties, and you walk away.

PCH is all about simplicity and the lowest monthly cost. Read our full guide to PCH.

6. The REAL Difference: The End of the Contract

The single biggest difference is what happens at the end. This is the entire point. Do you want flexibility and potential equity (PCP), or do you want simplicity and the lowest cost (PCH)?

With PCP, you are in control, but you also carry the risk. You are betting that the car's value will be higher than the GMFV. You have to decide whether to sell, part-exchange, or pay. It's a more involved process.

With PCH, you have no control, but you also have no risk. The car's future value is not your problem. You are simply handing back the keys. It is a clean, simple transaction.

7. The Engine of Your Payment: Understanding Depreciation

Both PCP and PCH are just different ways of paying for the same thing: depreciation. You don't pay for the car; you pay for the part of the car you use.

A car's 'Residual Value' (RV) is what it's expected to be worth at the end of your contract. Your monthly payment is based on the difference between its price today and its RV in 3 years.

This is why a premium car with a high RV (e.g., a Mercedes that holds its value) can have a surprisingly similar monthly payment to a cheaper car with a low RV (e.g., a brand that depreciates quickly). A high RV means there's less value to pay for. Read our full guide to car depreciation.

8. The 'APR' Question: A Critical PCP Difference

This is a simple but fundamental distinction that is crucial for your finances.

- Leasing (PCH) is a rental agreement. There is no loan, so there is no APR or interest. The price you see is the price you pay.

- PCP is a finance agreement (a loan). You are charged interest (APR) on the entire loan amount, including the final balloon payment.

This is a major reason why PCH monthly payments are often lower. With PCH, you are not paying interest on a large lump sum (the GMFV) that you may never end up paying. With PCP, you are. Read our guide to car finance APR.

9. The "Equity" Question: Myth, Reality & A Worked Example

PCP is often "sold" on the idea of equity. But is it real?

PCP Equity: Sometimes. The GMFV is the finance company's conservative guess of the car's value in 3 years. If the used car market is strong (as it has been recently), your car's trade-in value might be £2,000 more than the GMFV. That £2,000 is your equity. However, if the market is weak, your car might be worth exactly the GMFV, leaving you with zero equity.

PCH "Equity": This is the simplicity of leasing. You get no equity. But you are also protected from negative equity. If you leased a car and the used market crashed, its future value is the finance company's problem, not yours. You are simply paying for the service of using the car.

PCP Equity: A Worked Example (With Numbers)

Let's use a £30,000 car on a 3-year PCP. The finance company sets the GMFV (balloon payment) at £15,000.

| Scenario | Your Car's Trade-In Value | Your GMFV (Balloon) | Your "Equity" |

|---|---|---|---|

| Scenario A: Strong Market | £17,000 | £15,000 | £2,000 (To use as a deposit) |

| Scenario B: Weak Market | £15,000 | £15,000 | £0 (You happily hand the car back) |

In Scenario A, you would part-exchange the car, using the £2,000 equity as a deposit for your next one. In Scenario B, you would simply hand the car back (Option 3) and pay nothing, protected by the "Guaranteed" GMFV.

10. PCP vs. PCH: The "What Ifs"

This is where the differences really matter. How do these products handle real-world scenarios?

What if I go over my mileage?

PCH: This is a hard-and-fast rule. If your contract allows 10,000 miles and your excess fee is 10p/mile, driving 11,000 miles will cost you an extra £100 (1,000 miles x 10p). Simple, but unavoidable. Read our guide to excess mileage.

PCP: It's more complex. If you choose Option 3 (Return), it works just like PCH—you pay the excess mileage penalty. But if you choose Option 1 (Pay) or Option 2 (Part-Ex), you don't pay the penalty fee... however, the extra mileage has reduced the car's trade-in value, which means your "equity" will be lower (or gone).

What if I damage the car (beyond Fair Wear & Tear)?

PCH: The damage is assessed at collection. You will be sent a bill for the repair cost, as defined by the BVRLA standard.

PCP: Again, it depends. If you Return the car, you pay damage penalties just like PCH. If you Part-Exchange or Buy it, you don't pay the penalties... but the damage has reduced the car's trade-in value, just like high mileage. You "pay" for it by getting less for the car.

What if I want to end the agreement early?

PCH: This can be difficult and expensive. Most finance companies will charge a fee, often 50% of the remaining rentals. See our guide to ending your lease early.

PCP: This is more flexible. You have a legal right to "Voluntary Termination" once you have paid 50% of the total finance amount (including the balloon payment). This can often be a cheaper way out than with PCH, but you must have reached that 50% milestone.

What if I have financial difficulties?

This is a critical, FCA-regulated difference and shows the risk profile of each product.

PCP (Flexible): As a regulated loan, PCP has a legal protection called Voluntary Termination (VT). Once you have paid 50% of the Total Amount Payable (your deposit + all your monthly payments + the final balloon payment), you can legally hand the car back and walk away with no more to pay (assuming it's in good condition).

PCH (Less Flexible): As a rental agreement, PCH does not have a right to VT. You must negotiate an **Early Termination (ET)** settlement. This is often a flat fee, such as 50% of your remaining rentals, which can be very expensive.

11. What About Business Users? (BCH vs. Business PCP)

This is a critical distinction that most guides miss. The choice is even starker for a business.

Business Contract Hire (BCH): This is the dominant choice. Why? VAT benefits. On a business lease, a VAT-registered company can claim back 50% of the VAT on the monthly payments (and 100% of the VAT on any maintenance package). The rentals are also an allowable expense, which reduces corporation tax. It's an "off-balance-sheet" product, meaning it's simple accounting. See our guide to BCH.

Business PCP: This is less common. You can't reclaim VAT on the monthly payments, and it's a more complex "on-balance-sheet" asset. Its main use is for businesses that need to own their vehicles (e.g., highly modified vans) or for directors as an alternative to a traditional company car.

12. The Verdict: Who is PCP For? Who is Leasing For?

There is no "better" product, only the product that is better for you.

PCP (Personal Contract Purchase) is for you if...

- You want to keep your options open.

- You might want to own the car at the end.

- You like the idea of building "equity" for your next deposit.

- You are unsure about your exact mileage or future plans.

- You want more flexibility to end the agreement early.

Leasing (Personal Contract Hire) is for you if...

- You want the lowest possible fixed monthly payment.

- You definitely want a brand new car every 2, 3, or 4 years.

- You are confident in your annual mileage and can stick to it.

- You have no desire to ever own the car.

- You want the ultimate simplicity: just drive the car, hand it back, and get a new one.

13. PCP vs. Leasing FAQ

Often, leasing (PCH) has a lower monthly payment because you are only paying for the vehicle's depreciation, with no option to buy. However, the 'cheaper' option depends on your long-term goal. If you want to own the car, PCP is the route, but the total cost will be higher.

A GMFV is only used in PCP. It is the finance company's guaranteed minimum value of your car at the end of your contract. This figure is what you pay if you choose to buy the car (the 'balloon payment'). It's set at the start, based on your mileage and contract length.

No. At the end of a PCH contract, you simply hand the car back. There is no 'equity' or value to part-exchange. You are then free to start a new, separate lease agreement.

On PCH, you pay a fixed excess mileage charge for every mile over (e.g., 10p per mile). On PCP, if you hand the car back, you also pay an excess mileage charge. However, if you part-exchange or buy the car, the charge doesn't apply, but the high mileage will reduce the car's trade-in value, thereby reducing your potential 'equity'.

PCH is often better if you want the lowest monthly cost, a new car every 2-3 years, and no worries about selling the car. PCP is better if you want the flexibility to own the car, are unsure about your future plans, or want to use potential 'equity' as a deposit for your next car.

Voluntary Termination (VT) is a legal right on PCP agreements that allows you to return the car once you have paid 50% of the total finance amount (including the balloon payment). This right does not apply to PCH (leasing), which has a different process called 'Early Termination'.

14. Conclusion

The "PCP vs. Leasing" debate has no single winner, only the right choice for your specific situation. Your decision should be based on how you view the end of the contract.

Do you want the flexibility of choice and potential equity? PCP is your answer.

Do you want the simplicity of the lowest monthly payment and a clean break every few years? Leasing (PCH) is for you.

Whichever path you choose, browse our personal car leasing deals (PCH) or contact our expert team to discuss your finance options.